If you’ve ever said, ‘I can fix this leaky sink myself’ or ‘I can put this bed frame together on my own’, only to fail at your attempted handywork, you’ve likely fallen victim to overconfidence bias. Let’s face it; we’ve all encountered a situation in which we have overestimated our abilities. Overconfidence bias is one example of the many heuristics and biases that can compromise our decision-making, and precisely what behavioral science aims to help us avoid.

Overconfidence bias is defined as the tendency by individuals to overestimate their knowledge and skills while also being unaware that their overconfidence is unfounded. In a financial context, overconfidence is exacerbated through the unfettered access to information on the internet, which inflates the readers’ belief that they can ‘beat the odds’, when not even professionals can outperform the market on a consistent basis. Overconfidence, in this context, can lead to investor pitfalls like over-trading, neglecting risk, and becoming less willing to seek and follow financial advice.

Overconfidence, illusion of control, representativeness, and loss aversion, were the four biases found to influence investors’ decision-making, according to The Value of Behaviorally Informed Financial Advice - the largest financial study using behavioral economics of its kind - conducted by the BEworks Research Institute. The powerful influence of these four biases may ultimately override the advice of financial advisors, leading investors to devalue and disregard financial advice, and instead rely on their own abilities to make investment decisions.

This is worrisome for both investor and advisor in the financial sector, with $30 to $50 Billion in estimated losses from American consumers engaging in Do-It-Yourself (DIY) investment¹. Furthermore, a recent survey shows that consumer’s perceived value in financial advice is declining, with 34% of millennials, 31% of Gen Z’s, and 21% of Gen X’s planning to stop using a financial advisor2.

Yet following professional financial advice is proven to increase financial returns for investors. In fact, having a financial advisor is retrospectively correlated with incremental returns of up to 290% after 15 years, compared to not having professional advice at all3.

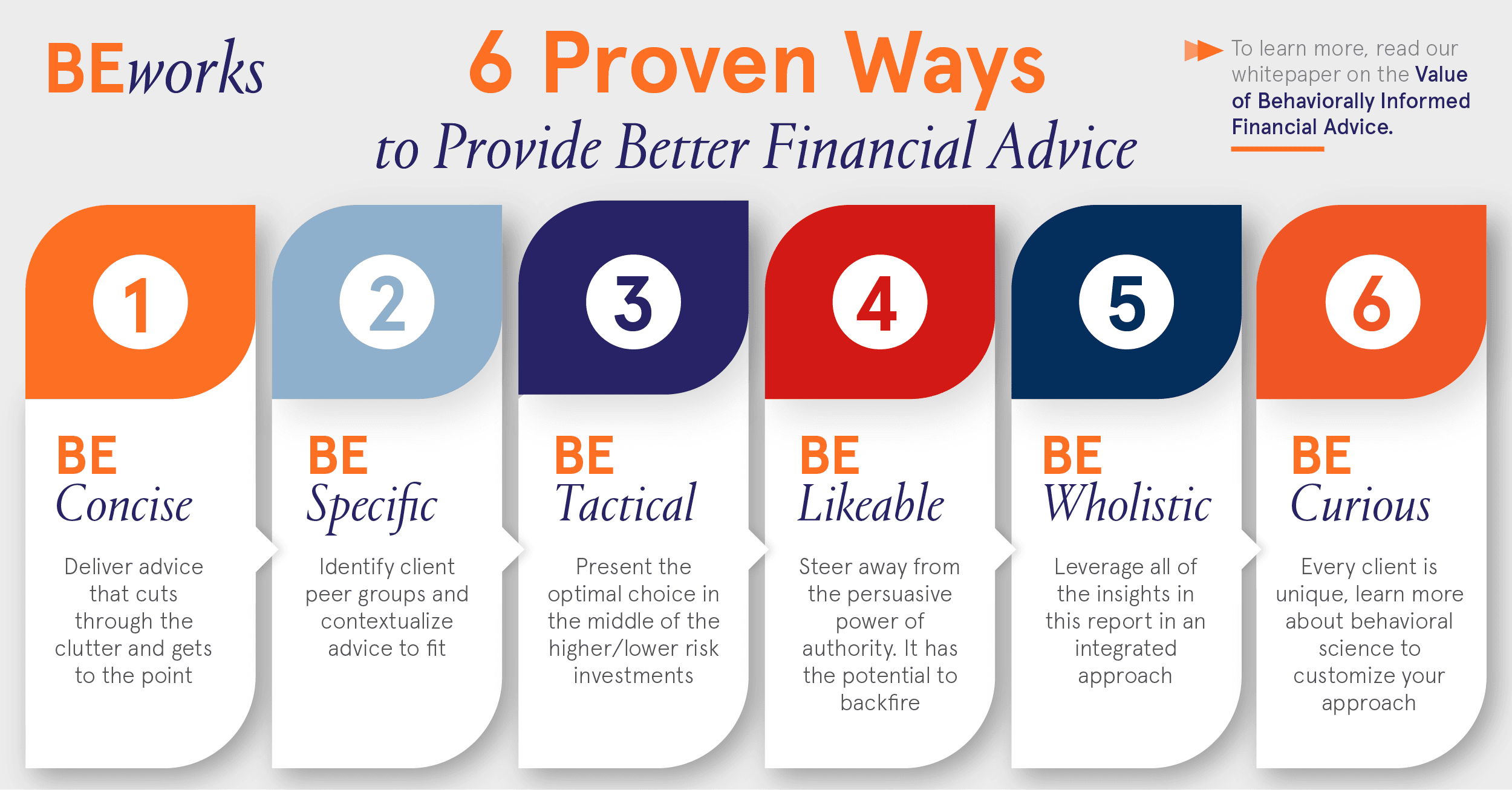

In our study, we found that incorporating behavioral economics principles into the way advisors interact with their clients creates tangibly superior outcomes. Behaviorally informed financial advice led to increased portfolio diversification and a higher Sharpe ratio in client investments compared to those achieved through conventional financial advice. Qualitative benefits were also apparent in clients’ perception of increased value of advice, increased trust in the advisor and an increased likelihood of seeking and following advice in the future.

Here are the six behavioral science tactics we found to help financial advisors deliver better advice:

Download the full case study here.

References

1. Reuters. “Overly Cautious Savers Risk Losing a Fortune.” New York Times, November 19, 2000. https://www.nytimes.com/2000/11/19/business/personal-business-diary-overly-cautious-savers-risk-losing-a-fortune.html

2. Finder.com. (2021). Financial Advisor Report. https://www.finder.com/ca/financial-advisor-report

3. Montmarquette, C., & Viennot-Briot, N. (2019). The Gamma Factors and the Value of Financial Advice. Annals of Economics & Finance, 20: http://aeconf.com/Articles/May2019/aef200115.pdf