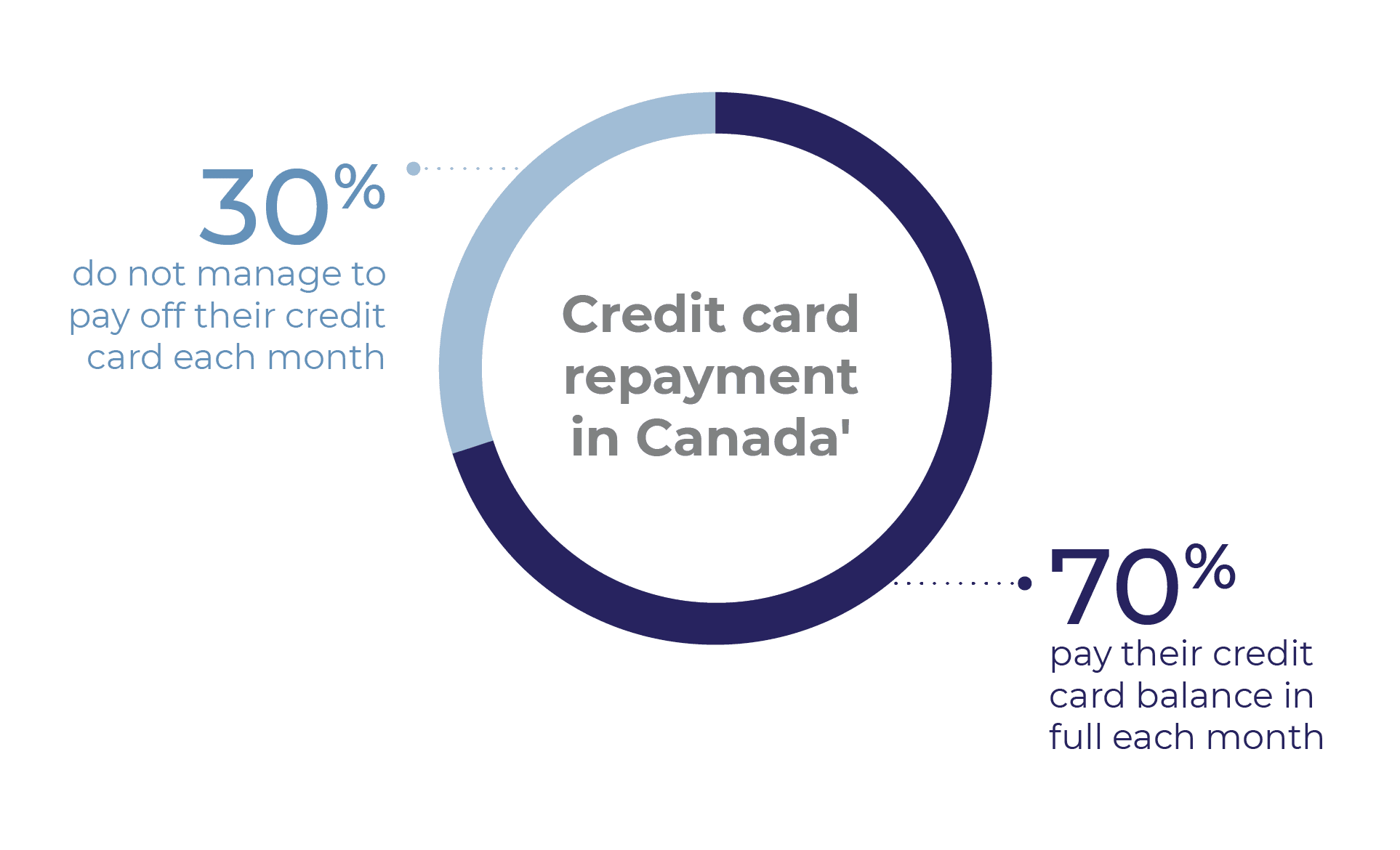

Credit card debt is an enormous problem. In 2019, the overall credit card balances in Canada reached a record high of over $100 billion for the first time in history. And yet, only 70% of Canadians pay their credit card balance in full each month, meaning that 30% do not manage to do so.

The failure to repay credit card debt can be explained by a variety of reasons.

It has long been established that the latter, the fruitlessness of paying down debt, plagues even those who hold enough savings to pay down the debt, often referred to as co-holding.

In most cases, the repayment of credit card debt is a process in and of itself. With typical repayment, consumers simply enter the amount they wish to pay toward their total balance – often the minimum required payment. But research has found that the mere presence of the minimum payment option actively reduces the amount of debt being repaid and increases usage of this option to the level of a default. Knowing this, it behoves us to ask: are financial institutions doing the best that they can do to facilitate debt repayment? And can behavioural economics teach something about what can be done?

In the last few months, a recent working paper released by Harvard Business School has introduced a new way of repaying credit card debt: repayment-by-purchase. Rather than following the standard system of credit card debt repayment, this method allows consumers to select specific purchases (e.g., a coffee at Starbucks, a utility bill) that they wish to repay, and make payments specifically directed towards “extinguishing” that debt. The results of this sudy shed light on a promising new system for maximising debt repayments.

Across three experiments included in the publication, participants made a chosen payment amount toward actual or hypothetical credit card balances after being randomly assigned (or given the opportunity) to allocate that payment toward the total balance (typical repayment) or toward specific purchases that made up the balance (repayment-by-purchase).

In the first study, the researchers found that, when choosing between typical or by-purchase repayment, individuals made significantly higher payments underrepayment-by-purchase compared to typical repayment conditions.

The next set of experiments explored the mechanism underlying this increase in repayment. Firstly, a set of questions revealed that engaging in repayment-by-purchase helped individuals perceive a greater sense of progress toward reducing their debt – an effect that went hand-in-hand with a greater awareness of what purchases were being repaid. A further lab-based experiment explored whether the repayment-by-purchase benefit might be explained by the simple mental accounting benefits of partitioning debt into specific categories.

To test this possibility, the researchers compared a repayment-by-purchase condition with a condition in which consumers got to pay off debt partitioned by category (e.g., entertainment, clothing, tech devices). They found that, while repayment-by-category offered a marginal boost to repayment rates compared to the traditional approach, repayment-by-purchase still came out as the top performer. Thus, partitioning debt may have some psychological perks - but tracing debt back to specific purchasing episodes goes above and beyond that when it comes to boosting the motivation to extinguish debt.

One question we couldn’t help but ask, as a team of applied behavioural economists, is: would the principles uncovered in this study work outside of the lab?

Luckily, the recent working paper offered us some answers. In addition to conducting three experiments, the researchers behind the publication took the question of real world applicability to a large Australian bank, for a field experiment involving over 270,000 credit card customers. It turned out that those who were given the opportunity to allocate their payment toward specific purchase categories paid 12.18% more toward their debt balance than the control group, who did not receive this option.

This research offers several important implications:

The recent working paper offers valuable insights into how partitioning debt by-purchase can help individuals increase their debt awareness, boost their perceived progress towards repayment, and thereby motivate action to get out of debt. Findings like these are crucial to consider as we seek to help millions of customers improve and streamline their financial decision-making process. Doing so has the potential to not only benefit personal wellbeing, but also that of society and the economy as well.

REFERENCE:

1. Donnelly, G. E., Lamberton, C., Bush, S... & Norton, M. I. (2020). “Repayment-by-Purchase” Helps Consumers to Reduce Credit Card Debt.