The COVID-19 pandemic has accelerated the trend toward electronic payments. With lockdowns, many physical locations were no longer open.

Deciding whether to pay for a restaurant meal with cash or a card is replaced by food delivery ordered online. Even easier than reaching into your pocket, pulling out your cash, counting it, and seeing a dwindling supply of cash remaining, intangible electronic payments occur with a finger tap. Money is increasingly intangible as we spend more with cards, mobile payments, BNPL and e-transfers and as we buy more products and services online.

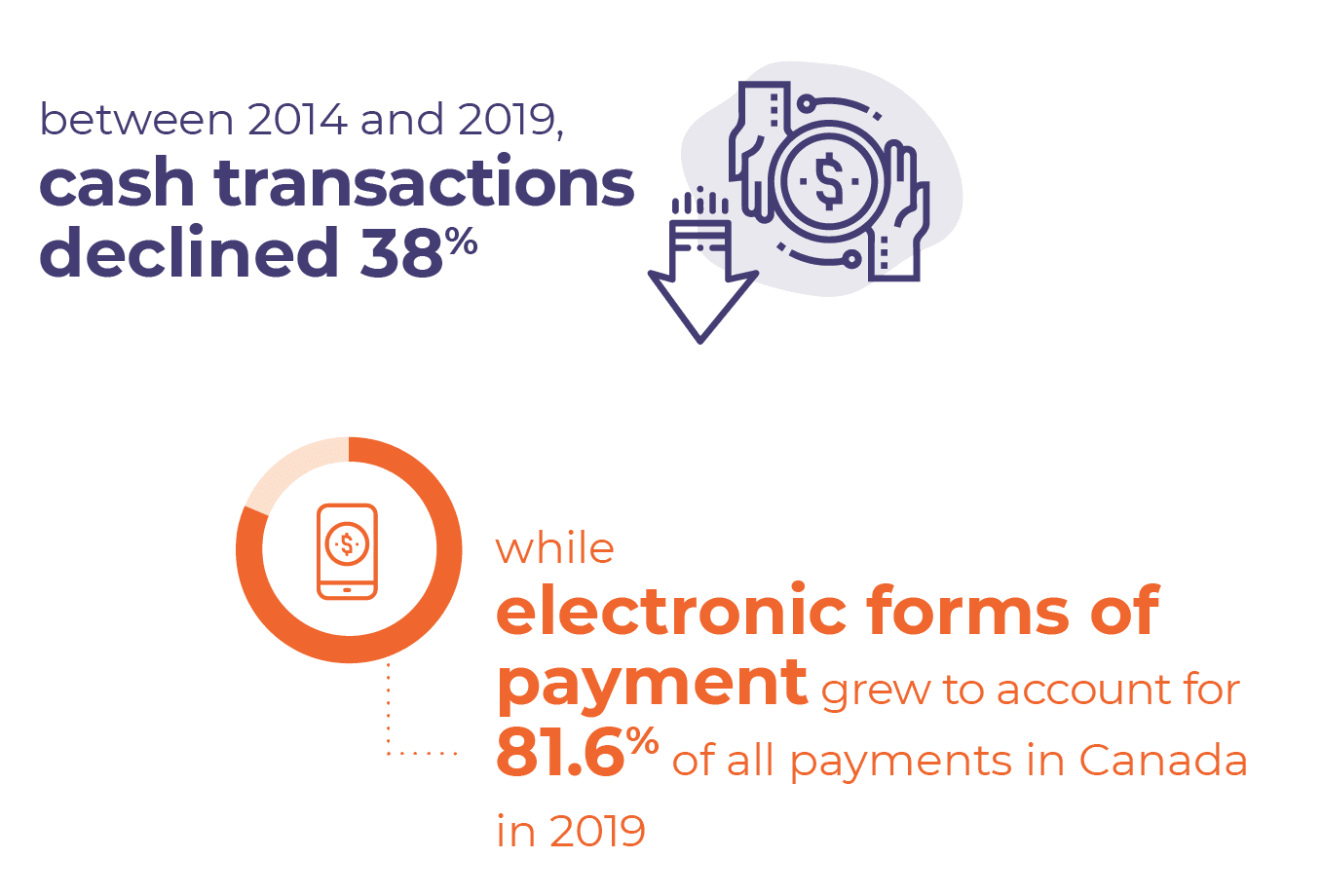

Payments Canada reports that, between 2014 and 2019, cash transactions declined 38% while electronic forms of payment grew to account for 81.6% of all payments in Canada in 2019.

Volumes are growing. In the first quarter of 2021, online money transfer provider PayPal processed 50 percent more payments globally than in the same period in 2020. The trends are accelerating with 18% of global retail sales being e-commerce based and the proportion is expected to grow to over 21% in 2024.

One might question whether there is any difference between physical cash payments and intangible electronic payments. The rational economic lens considers money fungible. One form has the exact same value as any other form. Viewed through a BE lens however, not all forms of payment have the same value. Even with physical currency, one dollar does not equal one dollar. The physical appearance of a bill affects its value and two bills of exactly the same denomination, where one looks newer than the other, have different perceived values. Fungibility is also violated with credit cards. Research demonstrates that when consumers have multiple credit cards and are contemplating a purchase, they will select a card with a lower outstanding balance rather than a lower rate. This preserves the perception of available credit, but it exposes the consumer to higher interest rates. Similarly, when paying off credit cards, consumers demonstrate debt account aversion and will favor paying off a single card, if possible, rather than allocating the funds to the card with the highest interest rate. Illusion of progress describes the feeling of making progress by eliminating one card even though the rational perspective would identify that the overall interest cost is higher. We know that none of these behaviors are rational, but they reflect actual behavior.

When money becomes intangible, other effects emerge. Taking money out of your wallet and handing it over gives us a tangible notice that we are parting with our money and depleting our wealth. Referred to as the pain of paying, we consider the pain of paying against the anticipated pleasure of our purchase. When we believe the pleasure will exceed the pain, we proceed. When the payment is electronic, the tangibility is eliminated, and the pain is therefore reduced, making us more likely to spend. As well, the immediacy of the pain of paying with cash is contrasted with the delay when paying electronically (debit card, credit card, BNPL, etc.) where the payment is visible later when we check our account with debit or occurs in the future with credit. This delay leads to temporal discounting whereby a dollar in the future is worth less than a dollar today. As well, with credit cards the purchase will be merged with multiple other purchases on a monthly bill, so the pain of paying is unlinked from the purchase. The result is that we are more likely to spend. This effect is compounded even further for those in a scarcity mindset who are biased to focus on short term current rewards and ignore future costs.

COVID-19 has forced people to do more shopping on-line as physical locations have been shuttered in lockdowns. As a result, even people who would prefer to pay with physical currency have been forced to use intangible payment methods. The shift towards intangible payments will likely be permanent as more people are now comfortable with something they were forced into. Reducing the pain of paying will make it more likely that we spend less wisely. It also makes it more likely that people will use credit unwisely to the detriment of their financial well-being. Consumers need to be aware of the increased risks as do lenders.

Debit cards are a convenient means of making payments. One recent trend that can help make debit card spending more tangible is electronic transaction notification. While introduced as a security measure to ensure that account holders are notified of debit card transactions, the notification at the time of payment is a reminder of wealth depletion and may help moderate spending. The same is true for transaction notification on credit cards.

Credit cards are also useful means for transacting. As well, credit cards offer payment deferral on purchases that sometimes must be financed over time. Sometimes borrowing is irresponsible as consumers are too present focused or they may significantly underestimate the cost of credit card debt. Other times, consumers explicitly value making a purchase and paying over time despite the additional cost. Lenders prefer manageable risks in their card portfolios. Borrowers have an interest is using credit cards wisely if they are to maintain or enhance their financial well-being. BE has suggestions to help both.

People are motivated to feel like they have checked something off their list, and so we can make use of this natural motivator to help people build and maintain better credit behaviors. It is difficult for consumers to keep track of the purchases they have made, and how this relates to an overall balance owing. If the balance owing is high, it may even feel like an insurmountable debt where repayment is “a drop in the bucket”. Research shows that if an overall balance is “chunked” into individual payments (e.g., $1,000 owing = $600 on a new bike, $200 on some new shoes, and $200 on groceries) that the amount repaid will be greater because consumers are more motivated to pay off “all of something” than “a part of something”.

While all types of debt could benefit from this strategy, we know that debt aversion is greater for some types of debt and that some types of debt are more visible than others. This means that making certain types of debt more visible and using this chunking strategy may be particularly useful. In fact, consumers are more likely to pay off debts accrued on “transient expenses” such as groceries, hotel accommodations, restaurant meals, and gas, than on “durable expenses” such as a television that takes longer to pay off. There is a perhaps unsurprising reason for this – people clear debt so they can feel freed up for future spending. Because people are less likely to imagine future spending on something like another television, they feel less motivated to “clear debt” to make way for more spending in these categories. They can also anticipate future pleasure from the television that they can balance against repayment in the future.

Assisting borrowers with mental accounting, and presenting information in a form that is consistent with how borrowers conceptualize their transactions, will increase the likelihood that borrowers are able to manage credit responsibly. Debt account aversion describes people’s preference to eliminate debt accounts. They have a natural inclination to pay off cards if they can. The goal-gradient hypothesis describes the increase in motivation we feel when we believe the goal is closer and more attainable. Sometimes, the number of debts or the total amount may leave consumers feeling helpless and therefore demotivated. Showing categories for chunking, providing information that makes progress seem possible, and rewarding that progress over time, will help lenders manage credit card portfolio risk. As well, consumers will be better equipped to use credit cards responsibly and maintain payments to lenders thus benefitting the lenders while also enhancing their financial well-being.

This article is part of our Credit in the New Normal Series which dissects 5 credit trends brought on by the pandemic with a behavioral lens. To read the other articles in the series, click here.