The COVID-19 pandemic has impacted all aspects of our lives. Extensive damage to businesses, households, and society are now becoming apparent. These changes have created a discontinuity we will call the “new normal”. One interesting aspect of it is the impact on how and why consumers use credit – something we will be exploring over the next few weeks as part of our new blog and webinar series ‘Credit in the new normal’.

Many of the changes we are seeing are not obvious. According to the Financial Health Network, macro-level measures of household debt and savings appear to show that consumer financial well-being has improved. Nonetheless, 67% of Americans are still not financially healthy, which implies that such statistics obscure what is really happening to sub-segments of the population. The Bank of Canada reported in May 2021, over one year into the pandemic, that 1/3 of Canadians are unemployed or underemployed. In what has been dubbed a K-shaped recovery and what the IMF in the 2021 World Economic Outlook has called “divergent recoveries,” some segments of the population are saving more and borrowing less but a sizeable segment is reliant on government COVID-19 support payments and struggling financially. Many of them are turning to credit.

We believe this change in saving and borrowing patterns matters, since many of the pre-COVID-19 assumptions regarding credit are no longer valid. In the new normal, financial institutions need to re-evaluate risk. Policy makers need to focus on solutions for accelerating income inequality and declining financial well-being. And consumers need to carefully consider the benefits and costs of credit. Understanding current conditions and anticipating the post-COVID-19 aftermath is critical.

A traditional economics approach assumes that people are calculating, analytical, goal-oriented, consistent, even predictable, and make decisions that would result in the best possible outcome for themselves. But based on decades of research and countless examples of people’s seemingly illogical decisions (e.g. joining a gym and never going), we know the hyperrational account of human beings does not capture the reality.

Behavioral Economics (BE) offers a tool to consider the social, cultural, psychological, and emotional factors that influence people’s attitudes and beliefs, and ultimately their decisions and behaviors. Rather than assuming people are rational, BE assumes that people try to be rational but are constrained by their finite cognitive capacity. An inevitable consequence of this is that we routinely make use of non-conscious mental shortcuts (also known as heuristics) that considerably simplify our decision-making. For non-consequential decisions, the simplification is welcome, but can also make us vulnerable to biased and apparently irrational decisions. As well as heuristics, our decisions come to be influenced by a multitude of factors: from our emotional state (e.g. we are less likely to wait for a big reward when feeling depressed to something as irrelevant as the order in which information is presented (e.g. we are much more likely to order to item closer to the top of a menu, no matter what they are). These biases are so large and predictable, that our behavior is predictably irrational. In light of this, let’s examine the top 5 challenges and trends that are coming to characterize financial decision-making in the pandemic era.

1. What consumers and lenders can learn from the scarcity mindset

A BE perspective on COVID-19 reveals that consumers are likely to be experiencing a scarcity mindset due to a perceived shortage of financial and other resources (including social connection) that are in short supply due to COVID-19. And research can help us understand the cognitive, attitudinal, and behavioral changes that are evident in people experiencing this state.

When attention is absorbed by concerns over rent, food, and basic needs, thoughts of the future are forgotten. This context sheds some light on the phenomenon of borrowing with payday loans or credit cards to meet immediate needs regardless of the future cost and potential downward spiral of borrowing.

Scarcity also leads to a general preference for smaller, sooner rewards over larger, later rewards. This means individuals experiencing scarcity-related distress more prone to focusing on immediate gratification and discretionary spending while failing to calculate the long-term costs and increasing debt. A credit score might be sacrificed in exchange for buying something pleasant rather than making a credit card payment.

Problematically, we know that, even when people have the best of intentions to economise and pay off expensive credit card debt, they are overconfident in their ability to reduce future spending and increase future income. For consumers, the long-term implications are worsening financial health. For lenders, the implications are that many assumptions regarding creditworthiness may be less true during times of perceived scarcity, requiring a re-evaluation of risk in granting credit. Key risks for lenders to be aware of are that consumers may be hungrier for credit than they normally would be and may even be accumulating “Buy Now Pay Later” (BNPL) loans that will not show up in traditional credit reports.

2. Buy Now Pay Later - a double-edged sword for consumers and lenders alike

BNPL – a credit product which has grown during the pandemic - offers a means of making payments both in bricks and mortar shops and online, but also an easy means to finance purchases and pay them off over time.

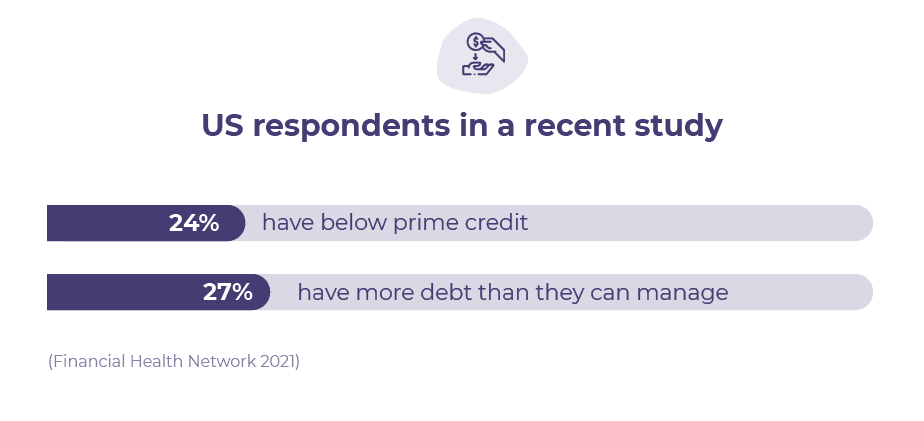

The costs of BNPL vary, with some having no interest or fees if the balance is paid on time. Others have high fees and interest rates, particularly for those with lower credit quality who turn to BNPL because they can’t qualify for a credit card. This particular segment is large, as 24% of US respondents in a recent study had below prime credit and 27% had more debt than they could manage.

The dark side of BNPL is that the convenience and payment deferral come at a cost – especially for some segments of the population. For “bad credit” customers, the cost can be as high as 400% annualized. Worse yet, BNPL is perhaps uniquely well-placed to enable people to pursue the purely hedonistic and short-term oriented desires that go hand-in-hand with a scarcity mindset. For example, Cardify, a payments research firm, found in a recent survey that two-thirds of respondents reported spending on items they would not otherwise have purchased if BNPL was not available.

Lenders need to be aware of this lurking risk since many BNPL providers do not report their loans to credit bureaus. Furthermore, consumers need to be aware of the temptations and consider long-term costs and consequences before taking advantage of the convenience BNPL offers.

3. The surprising risks of personal finance apps, savings defaults, and compartmentalization

Some assistance for managing one’s debt may be available from technology in the form of personal finance apps which support a number of financial behaviors, from borrowing and managing credit ratings, to online banking, fraud prevention, saving, investing, and financial planning. Computer and mobile device apps focused on personal finance have proven popular and represent a $7.5B market globally.

These capabilities for helping people manage their personal finances are important. People’s financial well-being is critical and has been found to be a key predictor of their overall well-being, comparable in impact to the effect of job satisfaction, relationship satisfaction, and physical health combined. Unfortunately, this form of well-being is in increasing danger.

The Financial Health Network reports that two-thirds of the people in America are merely coping or are financially vulnerable with the challenges of spending less than their income, paying bills on time, saving for short-term emergencies, saving for the long-term, managing their debt, and maintaining a good credit score. While there are fintech apps that can help with each of these challenges, they inevitably exclude many of the groups in the highest need. Lower income households may have less access to devices and apps. Furthermore, many low-to-moderate income households are over 50 and have lower usage of Fintech.

Besides raising questions of access, behavioral science also suggests that there may be other challenges. With apps for every aspect of financial life, there is a risk of excessive compartmentalization. BEworks’ research on financial planning has identified this phenomenon by the hallmark of biased attention that shifts people’s focus to one aspect of their financial life at the expense of others. For instance, saving more is counterproductive if expensive credit card debt remains unpaid. Yet people show a preference for keeping some savings regardless.

The potential traps associated with such illogical mental accounting and compartmentalization loom even larger as a result of personal finance app use, since an app that focuses on saving may lead users to neglect managing their borrowing to the detriment of overall financial health.

Another potential downside of personal finance apps is the licensing effect. Similar to people joining a gym and feeling they have made progress just by joining even if they rarely go, people may download an app but never benefit from it because they fail to change their behavior to save more, spend less, and use credit wisely One example is credit card transaction round-up. An app can automatically round up credit card transactions and shift the round-up amount to savings. This tiny amount is good but can’t really impact savings if the licensing effect means that the round-up is the only saving behavior and other spending behaviors do not change.

Other issues can emerge when personal finance apps try to leverage BE insights using defaults - e.g. by automatically transferring a monthly set amount to savings. This can create some positive change but can also make people excessively passive and inept at responding to dynamic changes in their income and other conditions. Consumers need to be aware of these traps and actively consider the impact of all of their behaviors on their financial well-being.

4. The intangibility of credit and our spending blindness

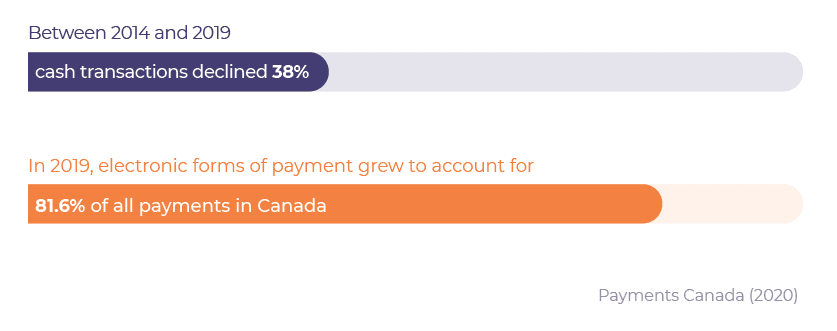

Money is increasingly intangible as we spend more with cards, mobile payments, BNPL, and online transfers. Payments Canada reports that, between 2014 and 2019, cash transactions declined 38% while electronic forms of payment grew to account for 81.6% of all payments in Canada in 2019.

The growth of e-commerce during COVID-19 lockdowns appears to be accelerating this trend. Online money transfer provider PayPal processed around 35 percent more payments than in the same period in 2020.

The rational economic perspective would have us believe that this is not an issue: after all, money is fungible and paying by cash or electronic means has the same cost. But BE research shows that people experience a pain of paying that subtracts from the pleasure of consuming. Taking tangible money out of your wallet potently couples that pain to your purchasing decision, while paying with a card or a click on BNPL uncouples the two factors and enables the pleasure of your purchase to exceed the pain. All of this means that our consumption habits can fundamentally change depending on how we ‘give away’ our money.

As more transactions become intangible, we are more likely to over-spend on unnecessary items and hedonistic experiences. Financial well-being becomes the victim. Consumers in a scarcity mindset, already overly focused on the short term and current rewards over future costs, are particularly vulnerable to this bias.

5. Real estate prices - a hallmark or cause of K-shaped recovery?

House prices have been rising in many countries over the past 5 years and longer, but this trend has accelerated with the COVID-19 pandemic.

Price appreciation may be driven by a desire for more space, as homes have also become offices for people working from home. There also seems to be a trend to move out of dense urban areas to areas with a lower population density. The outflow is sufficiently large that it is causing lower rental rates in many urban cores.

Another driver of home price appreciation is the low-interest rates maintained by central banks to support economies during COVID-19, but these low rates are also causing what the IMF refers to as excessive risk-taking and stretched valuations. The Bank of Canada notes that household mortgage debt is rising and now over 20% of housing demand is driven by investor speculation. Low-interest rates intended to support post-COVID-19 recovery are clearly causing unintended consequences and creating asset bubbles that introduce new risks.

One BE insight referred to as the Dunning-Kruger effect describes how people over-estimate their knowledge and capabilities and do so even more when they have limited knowledge. People may overestimate their understanding of the complex calculation regarding the relative costs and benefits of renting versus buying. People think of rent going to someone else and being wasted but they neglect to consider that mortgage interest is also similarly going to someone else. They also neglect to consider factors such as the potential returns on alternative investments for the equity in their home, real estate transaction costs, how long they plan to stay, taxes, insurance, and maintenance.

In the long run, the cost of renting versus buying should be equal as people switch to the cheaper option; for example driving down home prices and driving up rental prices. But representativeness bias, where people assume current conditions will continue uninterrupted in the future, optimism, and fear of missing out are creating a home ownership hysteria and a real estate market bubble.

Unfortunately, the global financial crisis demonstrated that housing could drop in value even faster than it rises, leaving many to abandon their homes along with their mortgages. Having leverage in the form of a mortgage means that the decline in value could easily exceed the entire down payment and all of the equity in the home. But that was over a decade ago and memories seem to be short.

The growth in real estate prices sees crucial ties with the aforementioned k-shaped recovery and growing income inequality. While some people splurge on property speculation and see their financial assets rise in value, members of lower income segments lacking financial assets are seeing home affordability disappear. Home buyers need to consider the risks as well as all of the costs and benefits. Lenders and policymakers need to address emergent risks in the new normal.

Credit in the new normal reflects changes in how and why we use credit. These changes create new risks and challenges. We need to go beyond traditional economic statistics and perspectives and leverage the insights of BE to understand why these changes are occurring before we can propose solutions.

Lenders need to be aware that assumptions in credit risk models need to be re-evaluated. Policymakers need to address excessive risk-taking for some and the changes that make it more difficult to establish a pathway to financial well-being for the financially vulnerable. Consumers need to understand the risks to their financial well-being in the new normal. By recognizing the changed conditions and consciously considering how the new normal may be affecting their decisions and behavior, we can enhance our financial and overall well-being.

Watch our webinar ‘Credit In the New Normal: Dissecting 5 Emerging Credit Trends with a Behavioral Lens’.